Content

If you are claiming a carryforward, enter the NOL deduction as a negative amount. For carryforwards, you must also attach a statement describing all the important facts about the NOL, including how you calculated the deduction. Carryback your NOL deduction to the past 2 tax years by filing your amended returns and carryforward any excess. Many businesses don’t make any money, particularly during their first year of operation.

The takeover is subject to the approval of the target company’s shareholders as well as regulatory approval to ensure that the acquisition complies with antitrust laws. Hostile TakeoversA hostile takeover is a process where a company acquires another company against the will of its management. Economic FactorsEconomic factors are external, environmental factors that influence business performance, such as interest rates, inflation, unemployment, and economic growth, among others. You can use the worksheet o page 3 of IRS Publication 536 Net Operating Losses to see the steps in this process. Corporations can also have a net operating loss, but this loss doesn’t affect individual owners .

Free Accounting Courses

However, the carryforwards are now limited to 80% of each subsequent year’s net income. If a business creates NOLs in more than one year, they are to be drawn down completely in the order that they were incurred before drawing down What Is Net Operating Loss Nol? another NOL. NOL tax laws have undergone significant changes in recent years. Net operating losses in 2021 or later may not be carried back, and NOL carryforwards are limited to 80% of the taxable income in any one tax period.

If the original return for the carryback year resulted in an overpayment, reduce your contribution by your share of the tax refund. Figure your share of a joint payment or refund by the same method used in figuring your share of the joint tax liability. Use your taxable income as originally reported on the joint return in steps 1 and 2 above, and substitute the joint payment or refund for the refigured joint tax in step 5.

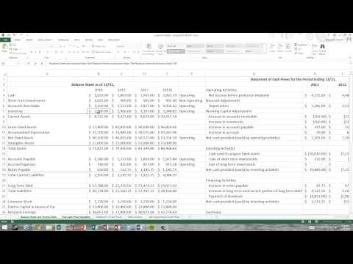

How to Calculate Net Operating Loss?

This portfolio analyzes net operating loss and credit carryovers during and after a change of corporate ownership. It also allows farmers who previously waived an election to carry back an NOL to revoke the waiver. This provision applies retroactively as if included in the CARES Act. The 80% limitation applies to REIT NOLs, but it does not apply to losses of non-life insurance companies. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

See IA 123 for further guidance regarding carrybacks and carryforwards. Prior to passage of the 2017 Act, NOLs could be carried https://quick-bookkeeping.net/ back to the two tax years before the NOL year. For example, the tax loss from 2015 could be carried back to 2013 or 2014.

How Net Operating Loss Works

You aren’t allowed to use a previous year’s NOL or the standard deduction to calculate NOL for 2019. There are other deductions that aren’t allowed, so it’s best to check the IRS website or consult with a tax professional to make sure you are considering the proper deductions. A net operating loss can smooth out the tax liabilities of good years using tax credits earned from not-so-good years. When a store is out of something on sale, you can get a raincheck allowing you to get the discount in the future. Similarly, a net operating loss is a credit you can use down the line.